Diabetic Neuropathic Pain Market Size, Drug Analysis, Epidemiology, Disease Management, Pipeline Assessment, Unmet Needs and Forecast 2031

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Diabetic Neuropathic Pain Market Overview

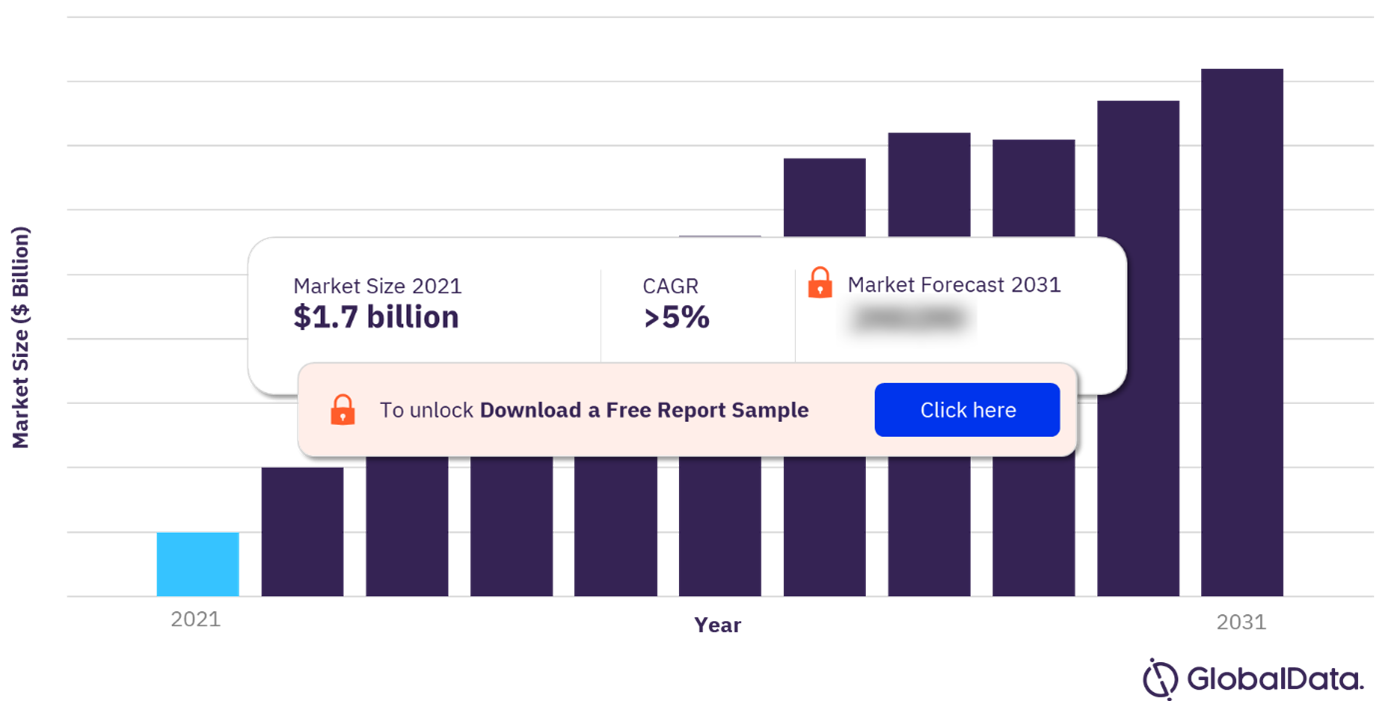

The drug sales across the 7 major markets (7MM) in the Diabetic Neuropathic Pain (DNP) market were estimated at $1.7 billion in 2021. The DNP market is expected to grow at a CAGR of over 5% during 2021-2031. The US market makes up the majority of total global sales, due to the large DNP prevalent population and the high price of medication in the country.

Diabetic Neuropathic Pain Market Outlook, 2021-2031 ($ billion)

To get more information on the diabetic neuropathic pain market forecast, download a free report sample

The diabetic neuropathic pain market research report provides an analysis of the key dynamics and insights into the key industry drivers and challenges impacting the diabetic neuropathic pain market. It also covers deals and R&D strategies in detail to highlight potential business opportunities. The report offers key metrics for diabetic neuropathic pain in the seven major pharmaceutical markets (7MM) including the US, 5EU (France, Germany, Italy, Spain, and the UK), and Japan during the forecast period from 2021-2031.

| Market Size (2021 in 7MM) | $1.7 billion |

| Key Regions | The US, 5EU, and Japan |

| Key Class Segments | SNRIs, Tricyclic Antidepressants, Gabapentinoids, Sodium Channel Blockers, Opioids, Topical Analgesics, Pipeline Agents, and Others |

| Leading Players | Viatris, Grunenthal, Eli Lilly, Helixmith Co, Glenmark Pharmaceuticals, Lexicon Pharmaceuticals, and Novaremed AG |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Diabetic Neuropathic Pain Market Dynamics

A total of four new pipeline products will launch, each of which of will have a higher annual cost of therapy (ACOT) when compared with the cost of the most used analgesics, which are highly genericized. The prospect of a disease-modifying therapy will also be welcomed for patients as the underlying pathophysiology of DNP will be targeted, rather than just being a symptomatic treatment.

In the 7MM, the number of 12-month total prevalent cases of DNP is expected to increase during the forecast period, which will lead to an increase in the treated population and drive sales.

However, the DNP market is crowded with inexpensive generic products for pain relief. The high use of these products is expected to continue throughout the forecast period. The ACOT of pipeline products is significantly higher when compared with the cost of generic analgesic therapies for DNP. This may restrict uptake, with payers and physicians preferring to prescribe cheaper alternatives when possible. The complex pathophysiology of the disease and the lack of understanding of the varied underlying mechanisms driving DNP have created some significant challenges for drug development.

Buy the full report to know more about the diabetic neuropathic pain market dynamics, download a free report sample

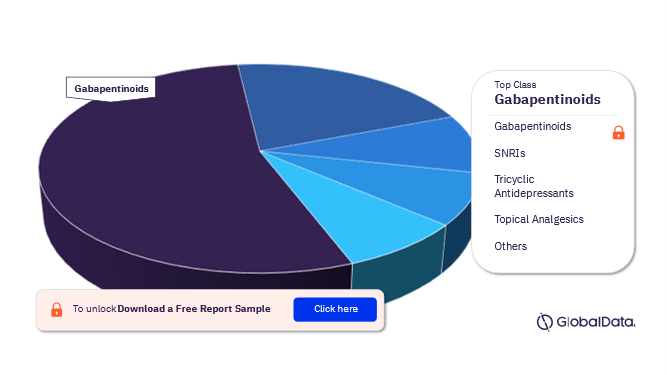

Diabetic Neuropathic Pain Market Segmentation by Class

The key class segments in the diabetic neuropathic pain market are SNRIs, Tricyclic Antidepressants, Gabapentinoids, Sodium Channel Blockers, Opioids, Topical Analgesics, Pipeline Agents, and others. In 2021, the gabapentinoids were the top-selling class of drugs, representing more than 40% of the DNP market. The gabapentinoids, pregabalin and gabapentin, are first-line treatments for the treatment of DNP, and they have higher ACOTs compared to SNRIs, TCAs, and sodium channel blockers.

Diabetic Neuropathic Pain Market Analysis by Class, 2021 (%)

For more insights on the class segments in the diabetic neuropathic pain market, buy the full report or download a free report sample

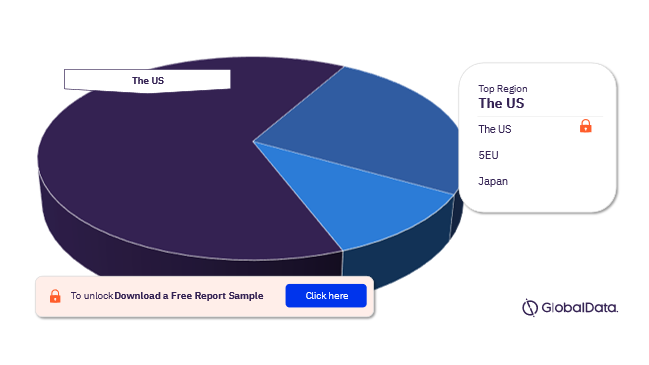

Diabetic Neuropathic Pain Market Segmentation by Regions

The key regions in the diabetic neuropathic pain market are the US, 5EU, and Japan.

The US: The US had the highest share in 2021 and will continue to dominate the DNP market throughout the forecast period. This is mainly due to the large prevalent population of patients with DNP, the high cost of drugs, and the number of drugs marketed exclusively in the US compared to other countries in the 7MM.

5EU: Of the 5EU economies including France, Germany, Italy, Spain, and the UK, the largest proportion of sales came from Germany. The regional growth can be mainly attributed to a larger population and therefore a higher number of total DNP-treated cases compared to the remaining European markets. Another key driver for the 5EU growth will be the launch of the pipeline product, ISC-17536 and will have a higher ACOT when compared with the cost of the most commonly used analgesics, which are highly genericized.

Japan: Despite the patent expiry of Effexor XR (venlafaxine succinate) and Vimpat (lacosamide), generic erosion in Japan is often more restrained than in other major markets, as generic drugs are less accepted, and patients remain loyal to branded products. The DNP market is crowded with inexpensive generic products for pain relief. The high use of these products is expected to continue throughout the forecast period.

Diabetic Neuropathic Pain Market Analysis by Regions, 2021 (%)

For more regional insights on the diabetic neuropathic pain market, buy the full report or download a free report sample

Diabetic Neuropathic Pain Market - Competitive Landscape

Some of the leading players in the diabetic neuropathic pain market are Viatris, Grunenthal, and Eli Lilly, Helixmith Co, Glenmark Pharmaceuticals, Lexicon Pharmaceuticals, and Novaremed AG. Of the late-stage pipeline products that are being developed for the treatment of DNP, Helixmith’s Engensis seems to be the most promising, with the highest clinical score and commercial score. This is attributed to its unique MOA, as it is a gene therapy that has demonstrated potential disease-modifying properties. Furthermore, Engensis is the only pipeline product that does not require daily administration.

Buy the full report to know more about leading diabetic neuropathic pain market players, download a free report sample

Key Segments Covered in this Report.

Diabetic Neuropathic Pain Class Outlook (%, 2021)

- SNRIs

- Tricyclic Antidepressants

- Gabapentinoids

- Sodium Channel Blockers

- Opioids

- Topical Analgesics

- Pipeline Agents

Diabetic Neuropathic Pain Regional Outlook (%, 2021)

- The US

- 5EU

- Japan

Scope

- Overview of diabetic neuropathic pain, including epidemiology, symptoms, diagnosis, and disease management.

- Annualized diabetic neuropathic pain therapeutics market revenue, cost of therapy per patient, and treatment usage patterns forecast from 2021 to 2031.

- Key topics covered include strategic competitor assessment, market characterization, unmet needs, clinical trial mapping, and implications of these factors for the diabetic neuropathic pain therapeutics market.

- Pipeline analysis: comprehensive data assessing emerging trends and mechanisms of action under development for diabetic neuropathic pain treatment. The most promising candidates in Phase III and Phase IIb development are profiled.

- Analysis of the current and future market competition in the global diabetic neuropathic pain therapeutics market. Insightful review of the key industry drivers, restraints and challenges. Each trend is independently researched to provide qualitative analysis of its implications

Reasons to Buy

- Develop and design your in-licensing and out-licensing strategies through a review of pipeline products and technologies, and by identifying the companies with the most robust pipeline.

- Develop business strategies by understanding the trends shaping and driving the global diabetic neuropathic pain therapeutics market.

- Drive revenues by understanding the key trends, innovative products and technologies, market segments, and companies likely to impact the global diabetic neuropathic pain therapeutics market in the future.

- Formulate effective sales and marketing strategies by understanding the competitive landscape and by analyzing the performance of various competitors.

- Identify emerging players with potentially strong product portfolios and create effective counter-strategies to gain a competitive advantage.

- Organize your sales and marketing efforts by identifying the market categories and segments that present maximum opportunities for consolidations, investments and strategic partnerships

Boehringer Ingelheim

Daiichi Sankyo Co

Eli Lilly

GlaxoSmithKline

Glenmark Pharmaceuticals

Grunenthal

Helixmith Co

Lexicon Pharmaceuticals

Mitsubishi Tanabe Pharma Corp

Mundipharma

Novaremed AG

Novartis

Ono Pharmaceutical Co

Pfizer

Regenacy Pharmaceuticals

Sun Pharmaceutical Industries

UCB

Viatris

Table of Contents

Table

Figures

Frequently asked questions

-

What was the diabetic neuropathic pain market size in the 7MM in 2021?

The diabetic neuropathic pain market size across the 7 major markets (7MM) was valued at $1.7 billion in 2021.

-

What will be the diabetic neuropathic pain market growth rate in the 7MM during 2021-2031?

The diabetic neuropathic pain market in the 7MM will grow at a CAGR of over 5% during 2021-2031.

-

Which are the key regions in the diabetic neuropathic pain market?

The key regions in the diabetic neuropathic pain market are the US, 5EU, and Japan.

-

Which region had the highest share in the diabetic neuropathic pain market in 2021?

The US accounted for the highest share of the diabetic neuropathic pain market in 2021.

-

Which are the key class segments in the diabetic neuropathic pain market?

The key class segments in the diabetic neuropathic pain market are SNRIs, Tricyclic Antidepressants, Gabapentinoids, Sodium Channel Blockers, Opioids, Topical Analgesics, Pipeline Agents, and others.

-

Who are the leading players in the diabetic neuropathic pain market?

Some of the leading players in the diabetic neuropathic pain market are Viatris, Grunenthal, and Eli Lilly, Helixmith Co, Glenmark Pharmaceuticals, Lexicon Pharmaceuticals, and Novaremed AG.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Diabetic Neuropathic Pain reports